A credit card dedicated to the LGBTIQ+ community

ABOUT COLORS

Colors positions itself as a key tool in closing the financial gap that the LGBTQI+ community faces in the job market. Its goal is to facilitate access to credit, help build credit histories, and improve the financial situation of its users. More than just a credit card, Colors offers a personalized Credit Builder within its app, encouraging on-time payments with rewards and connecting the community with offers and services tailored to their needs.

Colors also aims to strengthen its community commitment by actively participating in events like Mexico City’s Pride Parade and partnering with community-driven causes.

ROLE

Product designer

TIMELINE

Feb - April 2024

LOCATION

Remote

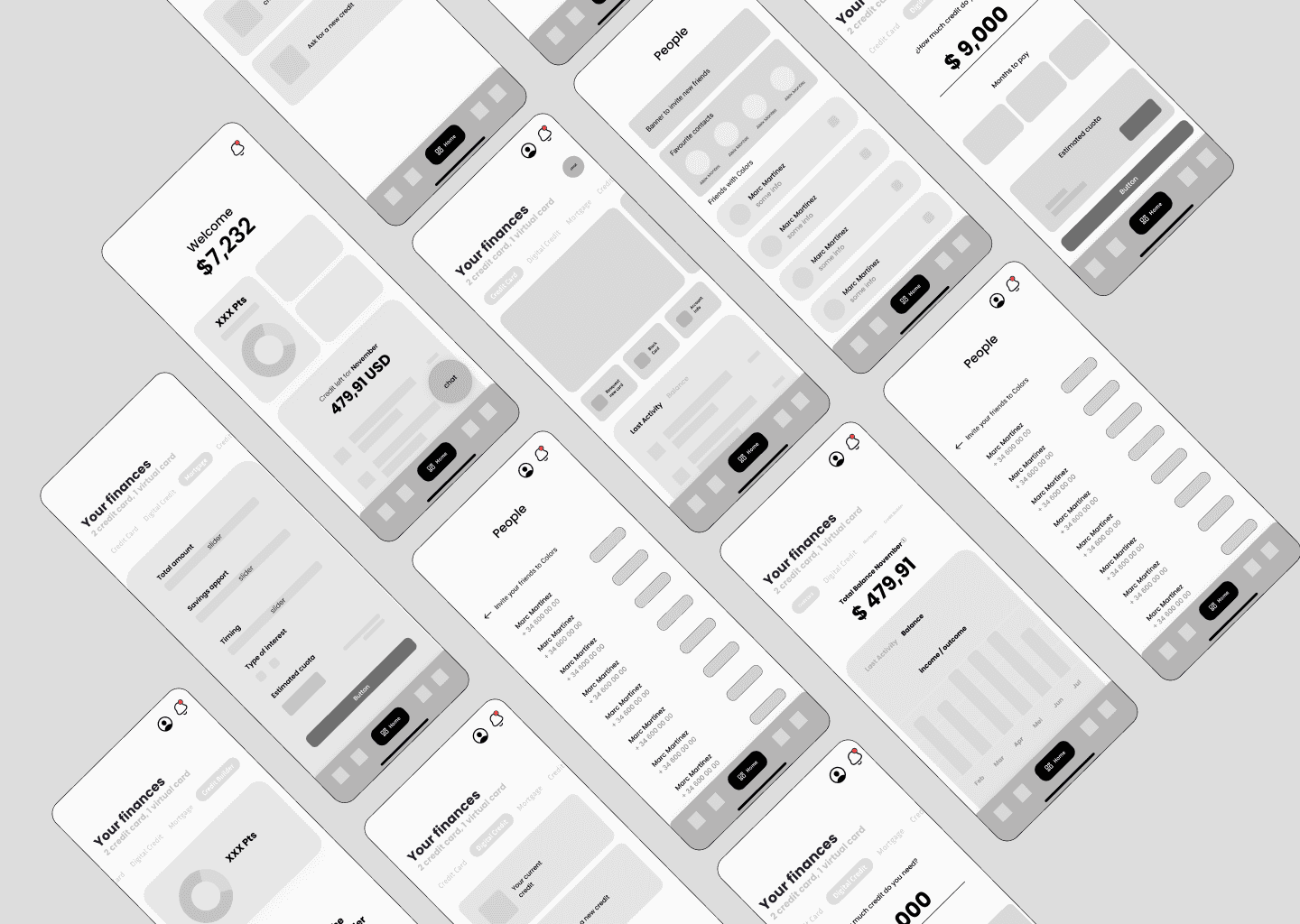

challenge

The goal of the project was to create a bank account interface with a credit card, where users could access their card, profile, credit builder, and community. To achieve this, we decided to divide the project into two sprints, one of which was solely dedicated to the credit builder section, as it proved to be more complex than expected.

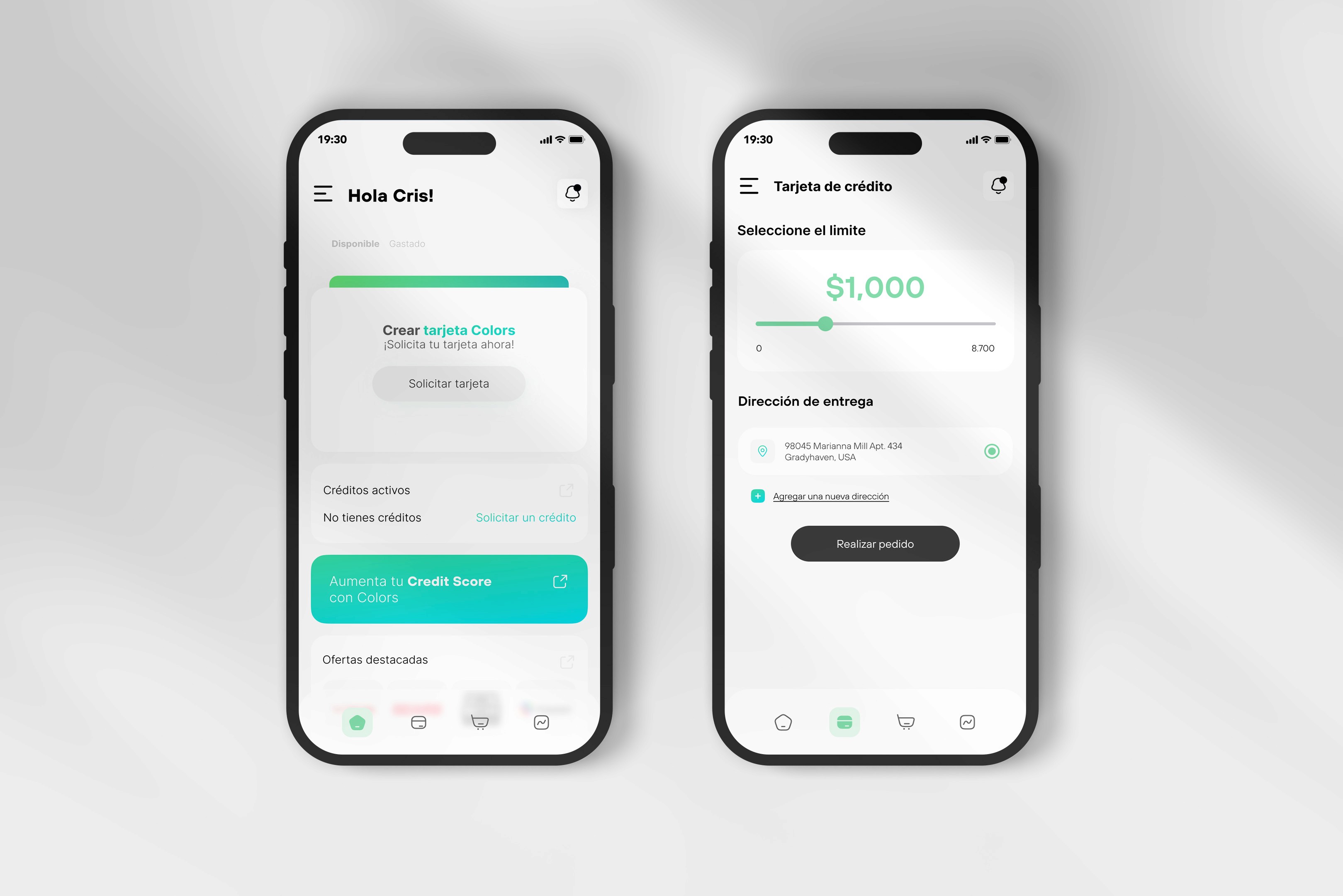

In the first sprint, we focused on developing the card dashboard, where users can access information such as card details, past purchases, card blocking and unblocking, requesting a new card, and viewing active credits.

For the second sprint, we dedicated more time to the research phase, as it involved the Mexican financial market, making it essential to understand the business rules. After a one-week design sprint with the project owners, we were able to refine the scope and move on to the building phase.

process

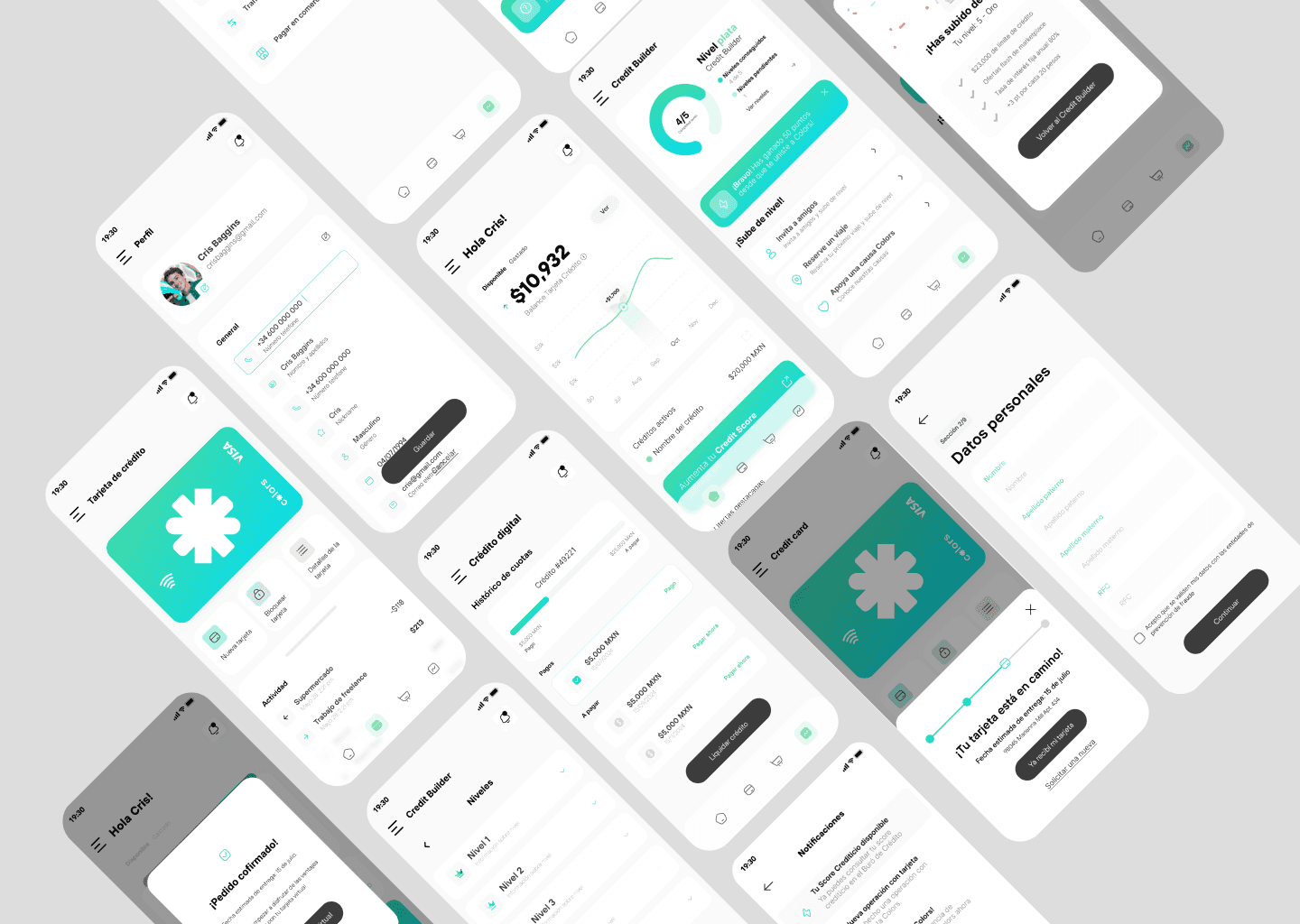

After the research and benchmarking phase, we moved on to building. Colors already had a strong visual identity and branding, so the challenge was keeping that laid-back, clean style while designing a banking app interface. We took a lot of inspiration from banks like Nubank and Revolut, which cater to a younger audience and have super user-friendly designs.

For the credit builder sprint, we spent the first week researching and getting a better grasp of Mexican banking rules and how credit scores work. Once we had that down, we started designing the interface.

Our goal was to make it gamified and easy to understand. We kicked things off with a short onboarding to guide users smoothly. From there, they land on the credit builder and digital credit dashboard, where they can see their current level and what steps they need to take to level up.

Outcome

After validating the credit builder section with users and making small adjustments to the flows—like adding back buttons and improving the copy—the result was a friendly, clean, and easy-to-understand interface.